Butterfly Equity acquires ePac to scale flexible packaging services

Key takeaways

- Butterfly Equity has completed its acquisition of ePac, a leader in digitally printed flexible packaging.

- ePac’s proprietary technology platform, ePacOne, can enhance order-to-demand production with 14 US and Canadian facilities.

- The acquisition supports ePac’s next-phase growth, leveraging Butterfly’s F&B industry expertise for innovation.

Butterfly Equity, a private equity firm, has completed its acquisition of ePac, a US-based producer of digitally printed flexible packaging, from the investor consortium, which includes Amcor and Indevco North America.

The holding company offers FMCG flexible packaging for food end markets. Its customers are high-growth leaders and innovators across small, medium, and large companies.

Virag Patel, CEO of ePac, says: “Over the past decade, ePac has redefined the packaging model by putting the most advanced technology in the hands of the world’s most innovative brands.”

“By partnering with Butterfly, we enter a new phase of acceleration. This partnership allows us to continue disrupting the industry while leveraging Butterfly’s connectivity throughout the F&B ecosystem.”

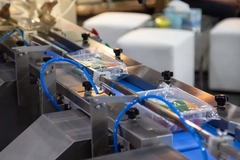

ePac’s proprietary technology platform, ePacOne, enables order-to-demand production across its network. The manufacturer has 14 facilities in the US and Canada, offering customers automated quoting, turnaround times, and consistent quality.

Patel continues: “Together, we will continue to evaluate and deploy next-generation technologies and platforms, like ePacONE, to deliver unmatched value and brand growth for our customers, regardless of their size or scale.”

Industry mergers

Butterfly is based in California, US, and invests only in the F&B industry. According to the company, it aims to generate consistent investment through data-driven processes and an operations-driven approach.

Eric Tommarello, managing director at Butterfly, says: “ePac’s management team has demonstrated a strong track record of execution, and we believe the combination of seamless technology, speed of service, and an obsessive focus on the customer experience has created a scalable foundation for continued growth in the digitally printed packaging category.”

The terms of the transaction have not been disclosed. The current leadership team continues to operate ePac and has retained a “significant ownership” interest in the business.

Recent acquisitions in the packaging industry include ProAmpac’s purchase of TC Transcontinental Packaging and International Paper’s bag converting division.

Last year also saw Amcor and Berry Global complete a historic business merger, which offers new growth opportunities and is expected to yield an estimated US$650 million in synergies.